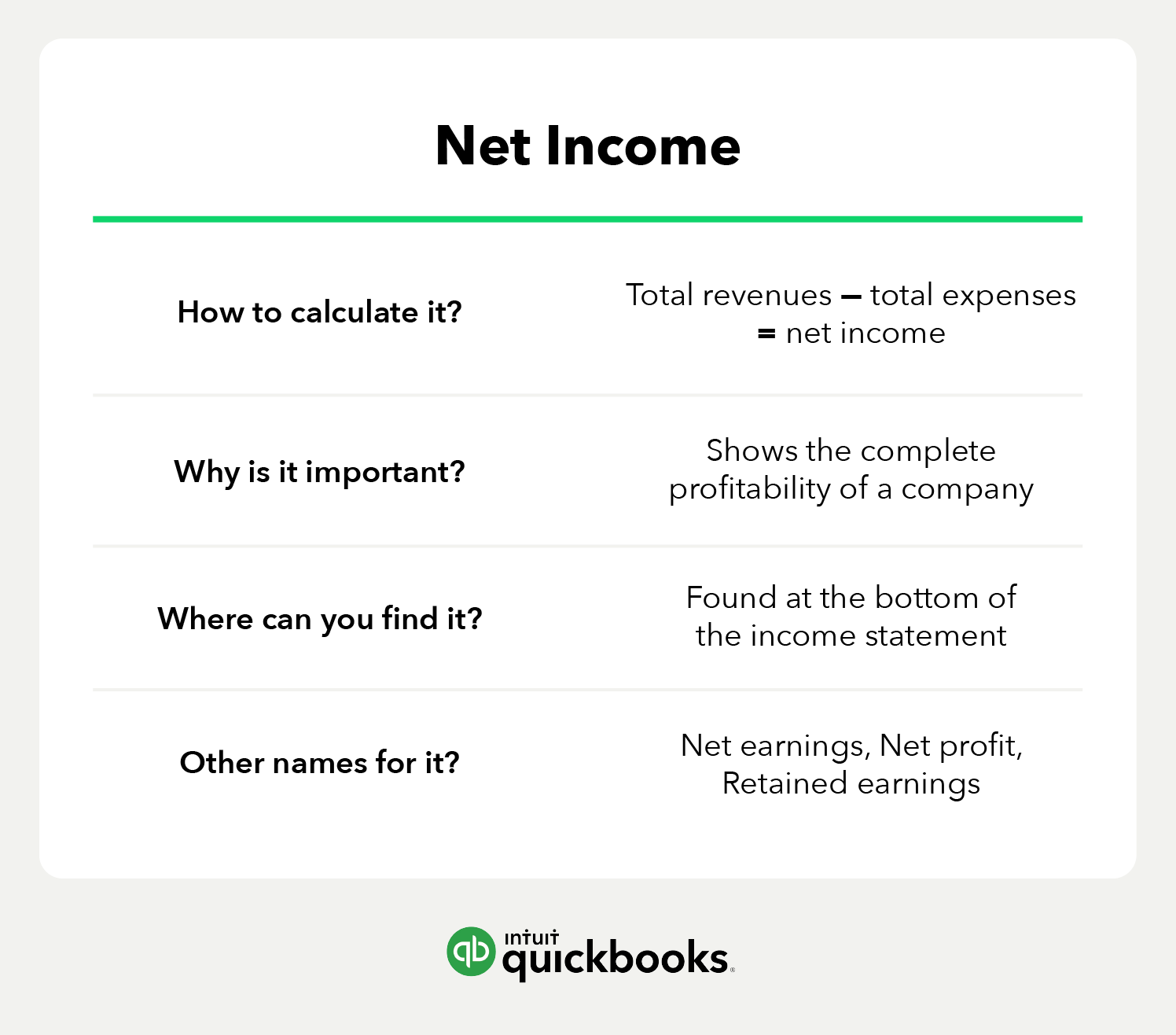

A company’s operating income can typically be found in its financial statements, such as the income statement (also known as the profit and loss statement). This statement provides a breakdown of a company’s revenues, expenses, and operating income, allowing investors and stakeholders to assess the company’s operational performance. Investors, creditors, and company management use this measurement to evaluate the efficiency, profitability, and overall health of a company.

Q. What Expenses are Included in Operating Expenses?

The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out. This can be achieved by cross-selling and upselling complementary products to customers. This allows the company to sell more products and reduce the need for markdowns.

Great! The Financial Professional Will Get Back To You Soon.

Remember, the operating income definition states that it measures the profits from the core business activities without taking into account extraordinary items. The higher the operating income, the more likely the company will be profitable and able to pay off its debt. Operating income measures the profitability of a company’s core business operations. If a company is not generating much operating income, this may indicate that core operations are being managed efficiently. The easiest way to calculate operating income starts with calculating gross income first.

Resources

By subtracting the total operating expenses from the gross profit, you arrive at the operating income. This figure demonstrates how much profit a company generates from its core operations before considering non-operational financial aspects. The operating income formula calculates operating income by deducting operating expenses from gross income. On the other hand, the EBITDA formula stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s profitability by adding back non-operating expenses and depreciation to operating income.

- To compute the contribution margin ratio, divide total contribution margin by total sales.

- You must understand the operations of a company before you can determine the operating income.

- These expenses include the costs of creating the goods that have been sold (COGS), salaries, inventory, marketing, depreciation, administrative costs, and operating expenses.

If a company has a particularly high debt load, the operating profit may present the company’s financial situation more positively than the net profit reflects. Additionally, the operating profit margin is often used as a metric to benchmark one company to other similar companies within the same industry. Operating profit margin is a profitability ratio used to determine the percentage of the profit the company generates from its operations before deducting the interest and taxes.

Operating Profit Margin

In the given case, only $500,000 is operating revenue as it is only related to the core activity of the business, and profit on the sale of equipment is not a part of operating revenue. To illustrate the significance of operating income, consider a hypothetical company, ABC Corporation. ABC reports an annual revenue of $10 million and incurs operating expenses of $6 million.

It is important to remember that operating income is just one of several metrics used to analyze a company or industry’s operations. It only tells part of the overall company story and must be used in conjunction with other metrics. Suppose ABC’s operating income was $2 million for the previous quarter and -$10,000 for the next one. Operating income is often included in an income statement, usually just before Earnings Before Income & Taxes (EBIT), a slightly more generalized measure of earnings.

It’s important to assess earnings at all levels of deduction, to understand performance in various aspects of running the business. If a company is successfully generating operating income but is poor at structuring its debt or losing income on other non-operating activities, then operating income is obstructing the larger picture. Famously, Warren Buffett recognizes the importance of operating income very well. He encourages investors in his company, Berkshire Hathaway (BRK.B), to look at the company’s operating income instead of net income.

There are different ways to calculate using the EBIT formula, although they all come to a common conclusion. The joy of every establishment is to record 2020 form 1040 tax table substantial progress over long years of operation. Monitoring the financial status of the business is one of the best ways to achieve this.

Leave a comment