After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue. This demonstrates that, for every Cardinal model they sell, they will have $60 to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit. In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage).

Contribution Margin for Overall Business in Dollars

Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\).

The Evolution of Cost-Volume-Profit Relationships

- In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights.

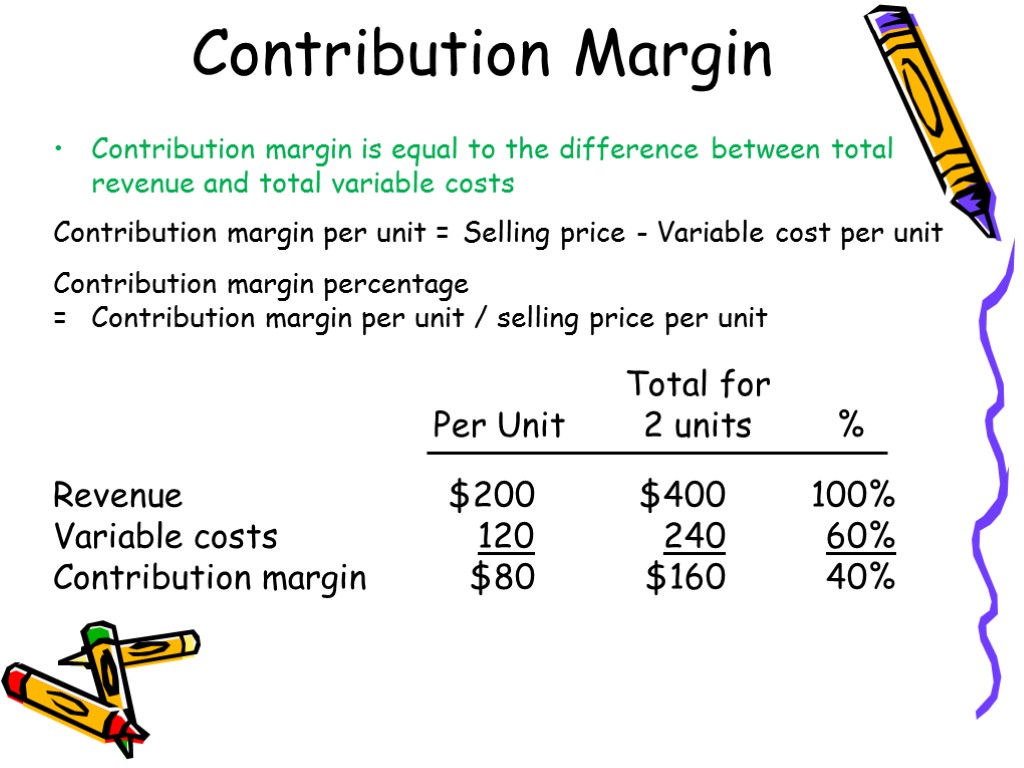

- The formula to calculate the contribution margin is equal to revenue minus variable costs.

- That is it does not include any deductions like sales return and allowances.

- For USA hospitals not on a fixed annual budget, contribution margin per OR hour averages one to two thousand USD per OR hour.

- On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances.

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period. This is if you need to evaluate your company’s future performance.

Would you prefer to work with a financial professional remotely or in-person?

Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. You pay fixed expenses regardless of how much you produce or sell. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same. You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products.

Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas.

The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps payroll software you pinpoint which products are the most profitable. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand.

Other reasons include being a leader in the use of innovation and improving efficiencies. If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow.

Furthermore, an increase in the contribution margin increases the amount of profit as well. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost. Such an analysis would help you to undertake better decisions regarding where and how to sell your products. Contribution format income statements can be drawn up with data from more than one year’s income statements, when a person is interested in tracking contribution margins over time. Perhaps even more usefully, they can be drawn up for each product line or service.

In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. For the month of April, sales from the Blue Jay Model contributed $36,000 toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line.

Leave a comment