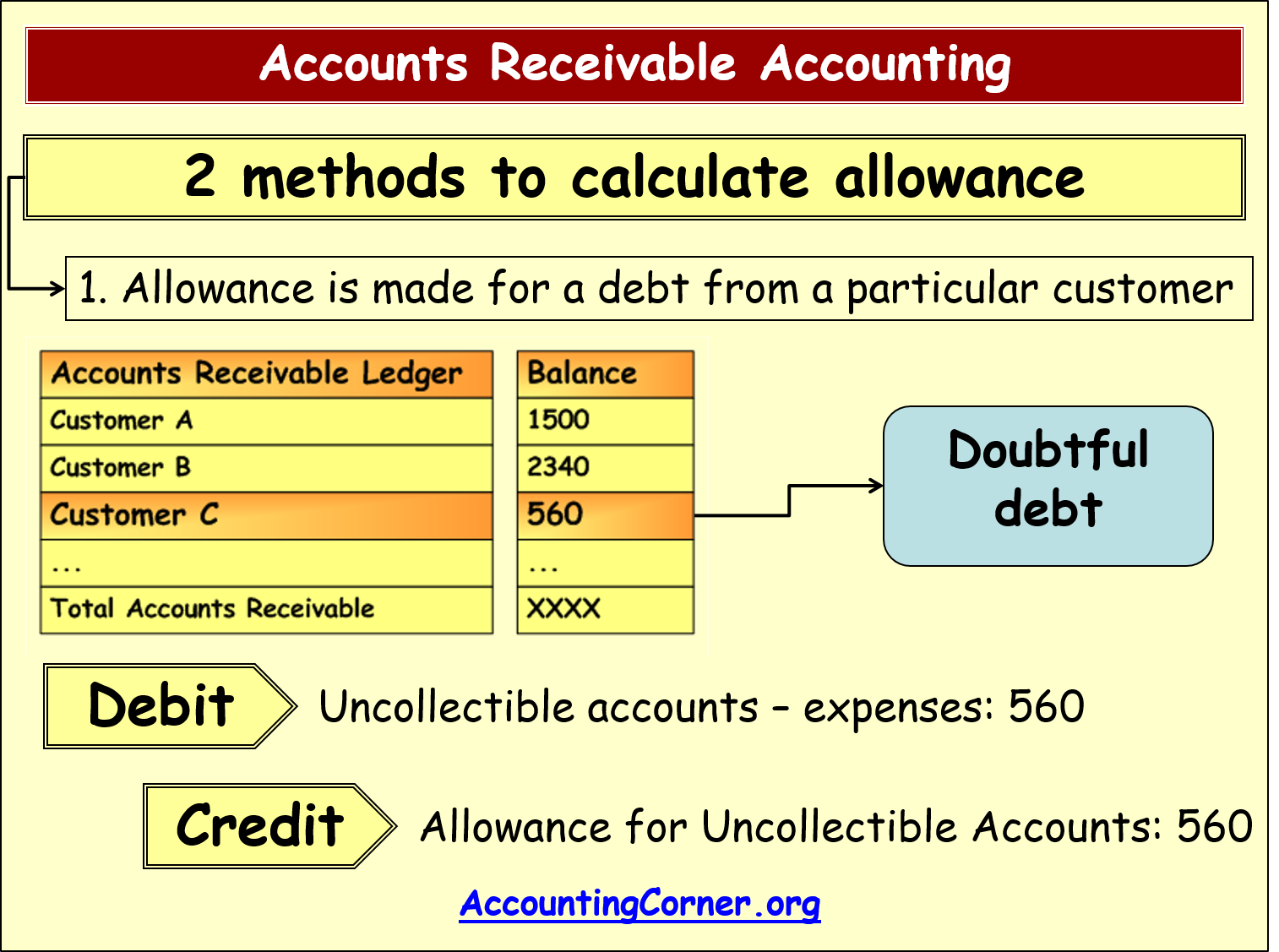

However, offering sales allowances voluntarily can demonstrate good customer service and foster customer trust. The allowance on sales gets calculated through the percentage of sales method, accounts receivable aging method, specific identification method, & management estimates. These techniques strive to offer a realistic approximation of the potential sales allowances and their effects on the financial statements. Companies must also present the sales returns and allowances figures in the financial statements.

What are Sales Discounts, Returns and Allowances?

Overshooting in sales is caused due to overstating of sales returns and allowances. When merchandise is returned by a customer or an allowance is granted, a credit memorandum (also known as a credit memo) is prepared. Companies may offer sales allowances for various reasons, which include the following.

How to Manage Accounts Receivable for Services Industry Company?

That’s why it’s vital to understand the items that come up on one, what they mean, and how to find and record them. You can use this strategy if your company has an overstock of inventory, for example, on seasonal items. You can also use a sales allowance when you have an aging inventory and it has been in your store for more than six months. The net Revenue balance on an income statement is calculated as gross Revenue minus all contra-revenue items like Sales Returns, Allowances and Discounts. Many companies working on an invoicing basis will offer their buyers discounts if they pay their bills early. One example of discount terms would be 1/10 net 30 where a customer gets a 1% discount if they pay within 10 days of a 30-day invoice.

Sales Allowance vs Sales Discount vs Sales Return

- Sales Allowances contra revenue account records the value of reductions in selling price granted to buyers who agreed to accept a defective product instead of returning it to the seller.

- Thus, the sales allowance is created after the initial billing to the buyer, but before the buyer pays the seller.

- Determining the appropriate amount for sales allowances requires a nuanced understanding of both the specific circumstances prompting the allowance and the broader financial implications.

- It occurs when the product is defective or performs below par with its expectation.

- As mentioned, some companies offer credit sales which can increase these numbers.

For example, a minor cosmetic defect might warrant a small percentage discount, while a significant functional defect could justify a more substantial reduction. Companies often rely on historical data and industry benchmarks to guide these decisions, ensuring that their allowances are competitive yet fair. Here, you’ll get a picture of what those terms mean, what those figures are used for, and how to record them on your income statement. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Then, you have to credit your accounts receivable or cash account by the same figure. In some cases, companies may use software tools to streamline the calculation process. Tools like QuickBooks or SAP can automate the tracking and calculation of sales allowances, reducing the risk of human error and ensuring consistency across transactions. These tools can also integrate with other financial systems, providing a comprehensive view of the company’s financial health and facilitating more accurate financial reporting.

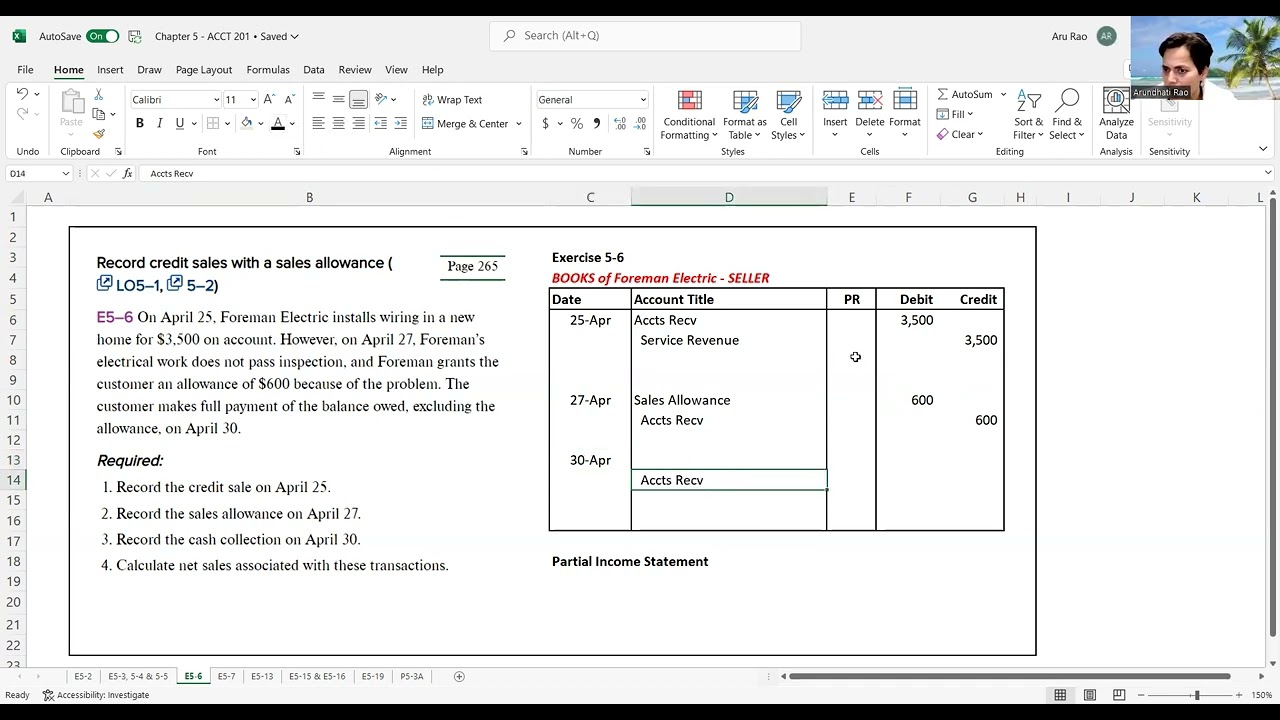

It helps accurately record returned or defective products in financial statements. Moreover, it saves the business from legal disputes, ensures customer satisfaction, and facilitates customer loyalty. Businesses can implement this through financial statement adjustments, issuance of credit memos, and providing account credits or cash refunds. Therefore, it is a form of sales adjustment that can help maintain customer satisfaction and avoid product returns. According to generally accepted accounting principles (GAAP), sales allowances should be recorded in the same accounting period as the original sale. This practice aligns with the matching principle, which states that expenses should be recognized in the same period as the related revenues.

Further, the allowance helps the seller save on returning costs, a full refund, legal issues, or a dent in its brand reputation. But, it offers certain advantages and disadvantages to both the seller and buyer. Credit Cash in Bank if a sales return or allowance involves a refund of a buyer’s payment. This requires a company to make additional notations to account for the item as inventory.

Net sales allowances are usually different than write-offs which may also be referred to as allowances. A write-off is an expense debit that correspondingly lowers an asset inventory value. Companies adjust for write-offs or write-downs on inventory due to losses or damages. The seller usually issues the customer a credit memorandum showing the amount of credit granted and the reason for the return. A return occurs when a buyer returns part or all of the merchandise they purchased back to the seller.

A difference between cloud engineer and devops engineer is a reduction in the price charged by a seller, due to a problem with the sold product or service, such as a quality problem, a short shipment, or an incorrect price. Thus, the sales allowance is created after the initial billing to the buyer, but before the buyer pays the seller. The sales allowance is recorded as a deduction from gross sales, and so is incorporated into the net sales figure in the income statement. A sales allowance refers to the price reduction in the actual selling price provided to a customer. It occurs when the product is defective or performs below par with its expectation.

Leave a comment